salt tax cap new york

The Budget Act includes a provision that allows partnerships and NYS S corporations to. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state.

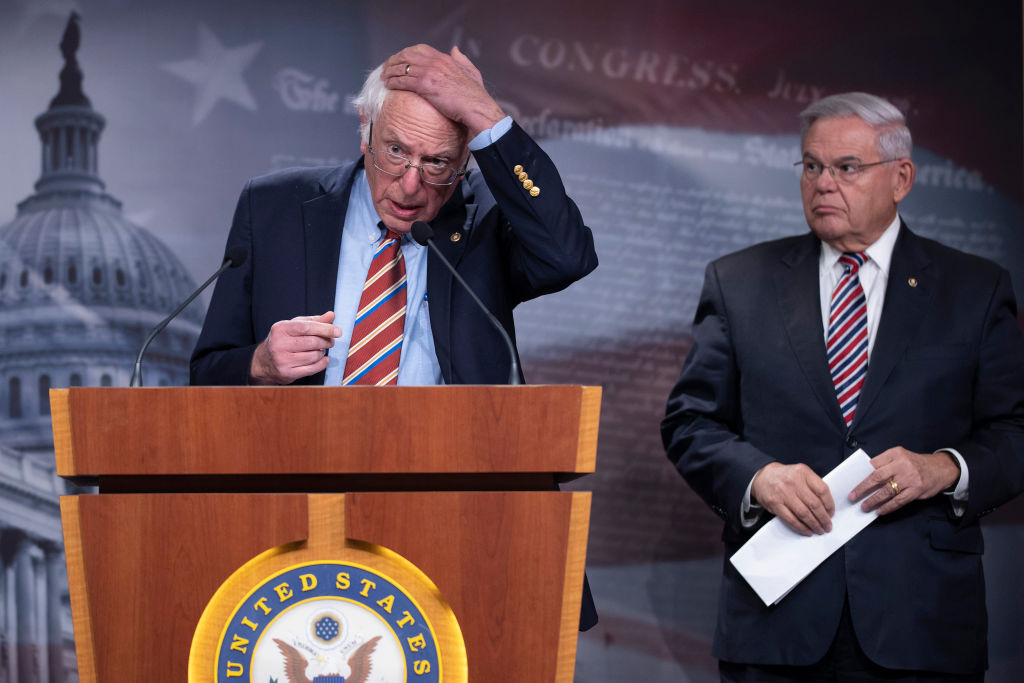

Why This Tax Provision Puts Democrats In A Tough Place Time

The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. In 2018 Maryland was the top state at 25 percent of AGI. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is. 16 might conclude that the editorial board supports lifting the 10000 deduction limit for state and local.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. This SALT cap applies to state and local real property taxes personal property taxes income taxes and general sales taxes. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

Why should someone in Pennsylvania earning 100000 pay more federal income tax. Lost a legal challenge to a provision of the 2017 law that limited write-offs for state and local taxes as a federal judge threw out a. Andrew Cuomos spin on the tax hikes in the.

On August 31 2022 New York Governor Kathy Hochul signed SB. The cap disproportionately affected those not subject to the alternative minimum tax AMT which denies certain tax breaks including the SALT deduction to subjected. New York has issued long.

An owner of the electing entity is entitled to a credit against hisher City personal income tax equal to the owners direct share of City passthrough entity tax PTET paid. A reader of The SALT Democrats Surrender Review Outlook Aug. The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent.

Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on.

New York seeks Supreme Court review of SALT cap. Note that as part of ongoing discussions in Congress around the. By Nick Reisman New York State.

9454 which aligns New York Citys nexus standards with New York States economic nexus standards. Bloomberg -- Four states in the eastern US. New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid.

52 rows States that benefit most from the SALT deduction include California New York Illinois and Texas. The 10000 cap is the same for single and. SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of high-tax states like New York and New.

Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. State Local Tax April 22 2021 No. New York is taking another run at repealing SALT cap.

Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. PUBLISHED 549 PM ET Apr.

Tom Suozzis letter Fighting the SALT Cap on Behalf of New York Aug. 2 On April 19 2021 New York Governor Andrew Cuomo. New York enhances SALT cap workaround for pass-throughs.

New York State is expanding a tax break that allows smaller companies to circumvent the 10000 limit on state.

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Dems Don T Repeal The Salt Cap Do This Instead Itep

Pro Salt House Dems Say They Ll Back Spending Plan

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

How To Deduct State And Local Taxes Above Salt Cap

Supreme Court Rejects Salt Limit Challenge From New York New Jersey

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

State And Local Tax Salt Deduction Salt Deduction Taxedu

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation